4.5 Simple Interest:

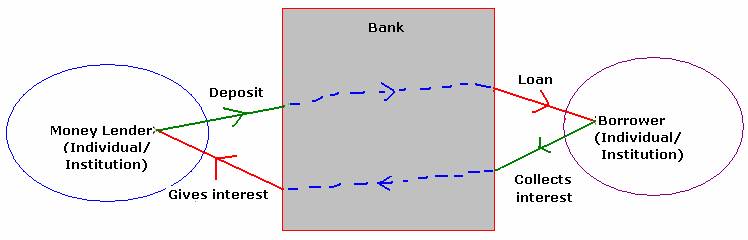

The money given by a

depositor to Bank or the money given by bank to a borrower is called ‘PRINCIPAL’ Amount.

The duration for which money

given by depositor to the Bank or the duration for which money is taken on loan

from bank is called ‘PERIOD or TERM’ The

interest one gets from bank or the interest charged by a Bank on a loan is

normally expressed as a % for an year. Since Banks also have to make profit after paying

for expenses ( rent for the building,

salary to its employees printing of stationary, electricity and other

expenses). Bank’s major income comes from interest charged on loans. They also pay interest to depositors. Thus, in order that Banks are profitable they

charge more interest on loans (around 5% more) when compared to interest given

on deposits.

|

|

4.5 Example 1:Ram

has deposited 5000Rs in State Bank of

What does 8% interest mean

to Ram? (The bank agrees to pay 8 Rupees for every 100 Rupees every year)

It is given that for Rs.

100 he gets 8 Rs per year (8% interest)

For Rs. 5000 he gets

8*5000/100 = 400Rs per year

Since he has deposited

Rs.5000, he should get Rs.400 every year for 6 years

In all he will get Rs.2400

(=400*6) as interest in 6 years from Bank

He will also get back his

principal amount of 5000Rs at the end of 6 years

In banking terms this

method of arriving interest is called ‘Simple Interest’

If

P = Principal amount (The

sum borrowed or the sum lent)

N = Period (Term) of

Deposit/loan in

years

R = Rate of Interest (The

interest amount on every Rs 100 for one year)

I = The

interest money paid by borrower to the money lender or to the bank for use of

money (P) borrowed

A =The amount paid/payable

at the end of period then(A = P+I )

For simple Interest

calculation we use the formula:

Simple Interest

(SI)= (P*N*R)/100

Let us verify correctness

of our interest calculation in the

above example using the above formula

Verification:

P = 5000

N= 6years

R = 8%

Substituting these values

in the above formula we get

Interest = (P*N*R)/100

= (5000*6*8)/100 = 50*6*008

=2400 which is what we arrived in the example

Since A = P+I and I =

P*N*R/100

A = P+ (P*N*R)/100 = P{1+ (N*R)/100}

For easy calculation of

interest, Bank employees use a table

called ‘Ready Reckoner’ (Pre calculated table of interest for

different amount and interest rates) for

calculating simple interest. It is a table showing interest amount for one

month or for one day for different ‘Principal’ amounts.

Sample Ready Reckoner for

interest for One Month is given below:

|

Principal(Rs.) |

Rate@

4% Per

Annum |

|

1 |

.0033 |

|

2 |

.0067 |

|

... |

….. |

|

10 |

.0333 |

|

20 |

.0667 |

|

30 |

.1000 |

|

40 |

.1333 |

|

50 |

.1667 |

|

100 |

.3333 |

|

200 |

.6667 |

|

300 |

1.0000 |

|

400 |

1.3333 |

|

500 |

1.6667 |

|

1000 |

3.3333 |

|

... |

….. |

4.5 Problem 1: Calculate

simple interest for Rs 550 at 4% for 4 months using the above Ready Reckoner

Solution :

Step 1. 550 = 500+50

(split the principal so as to use the table easily)

Step 2: Interest for one

month for Rs 500 = 1.6667

Interest for one month for Rs.50 = .1667

Step 3 :

interest for one month for Rs 550 = 1.

8334(=1.6667+.1667)

Step 4 :

interest for 4 months = (1.8334)*4 = 7.3336

Activity :

Visit a Bank and ask for a Ready Reckoner. You will notice that Interest is tabulated for the

principal amount from Rs 1 to 9 and then from 10 in multiples of 10 up to 50 and then multiples of 100 up to 500

and then multiple 1000 up to 5000 and so

on.

Did you ever think why it

is so? The reason is that any amount can be split among small numbers appearing

in the Ready Reckoner table

For example, 6047 =

5000+1000+40+7 and hence interest on 6047 is same as sum of interest on the

split amounts of 5000,1000,40,7

Note:

As per the

above ready Reckoner, For Rs.100 the interest at the rate of 4% is0.3333.

However, can we not calculate the interest on 100 in another way as (Interest

on Rs.1*100)= .0033*100=.3300. Notice the difference

in interest between two methods which is .0033. This is because, the calculation

of interest is done only up to 4

decimal places and hence a rounding error. If the amount deposited is very

large, the interest difference will be huge. Because of this reason, the person

who uses Ready Reckoner has to be careful.

Let us take the case of

borrower.

4.5 Problem 2: Mr. Raj borrows from State Bank

of

Solution :

In this case we have

P = 150000

R= 12

N =7

Substituting these values

in the formula we get

Total interest =

150000*7*(12/100) = 1500*7*12 = 126000

Since he also pays

principal loan amount at the end, his

total payment to bank will be Rs 2,76,000(=1,50,000as principal +1,26,000 as

Interest)

4.5 Problem 3: A sum of money amounts to Rs 3,360

at 14% Simple interest in 3 years. Find the interest on the same sum for 3 1/2

months at 6%

Solution :

In this case we have

A = 3360, R =14 and N=3

But A = P{1+ (N*R)/100}

3360 = P{1+ (3*14)/100} = p*142/100

![]() P = 3360*100/142 = 2366

P = 3360*100/142 = 2366

R = 6 and N = 3 1/2 months= 3.5/12 years

SI = (P*N*R)/100=

{2366*(3.5/12)*6/100} = Rs. 41.41

4.5 Problem 4:

Three sisters are 5, 10 and 15 years old. Their father leaves Rs80,250 in a bank; paying 5% simple interest. If each gets the

same amount at the age of 20, find their shares at the time of father’s death.

Solution :

Since each of the sister get the amount

at the age of 20 years. Let the sister’s share be P1,P2 and P3 respectively

First sister’s share (P1)

is held in the bank for 15 years

Second sister’s share (P2)

is held in the bank for 10 years

Third sister’s share (P3)

is held in the bank for 5 years

The amount got by first

sister after 15 years

= P1{1+ (N*R)/100}= P1{1+

(15*5)/100} =1.75 P1

The amount got by second

sister after 10 years

= P2 {1+

(N*R)/100}= P2 {1+

(10*5)/100} =1.5 P2

The amount got by third

sister after 5 years

= P3{1+ (N*R)/100}= P3{1+

(5*5)/100} =1.25 P3

Since it is given that the

amount they get at the age of 20 years is same

1.75 P1=1.5 P2=1.25

P3

On simplification we get

7P1=6P2=5P3

![]() P2

= 7/6P1

P2

= 7/6P1

and P3 =

7/5P1

But it is given that P1+P2+P3

= 80250

![]() P1+7/6P1+7/5P1=

80250

P1+7/6P1+7/5P1=

80250

I.e. (30+35+42)/30 P1=

80250

I.e. P1=

80250*30/107 = 22500

By substituting this value

we find that

P2 = 7/6P1=

26250

P3 = 7/5P1=

31500

The sisters share at the

time of their father’s death is Rs 22,500, Rs26,250

and Rs,31,500.

Verify using the

formula that these deposits fetch same amount when the sisters attain the age

of 20 years.

4.5

Summary of learning

|

No |

Points to remember |

|

1 |

Simple Interest (SI)= P*N*(R/100)

Where P =

Principal Amount N = Period (Term) of Deposit: R = Rate of Interest |