4.6 Interest

Calculation:

Banks

and post offices pay a nominal interest on the balance in SB accounts. The

interest % varies from time to time. In the case of Banks it used to be fixed by Reserve

Bank of

In the

case of Post

Offices, the interest is calculated on the basis of monthly minimum balance

maintained between 10th and the last day of each month. However,

from April 2010, Banks are calculating SB interest on balance held at the end

of every day.

4.6.1

Interest on Savings Bank Account in Banks:

In the

case of Banks the interest is calculated monthly but credited to the SB account

quarterly or half yearly.

Method

of interest calculation:

Let us

assume that an individual has following balances in the month of February of 2015

in his SB account in a Bank

|

Dates |

Account Balance |

No of Days with same balance |

Equivalent Balance held in 1 day |

|

On 1st,2nd,3rd,4th,5th |

2000 |

5 |

10,000(=2000*5) |

|

On 6th ,7th,8th,9th |

2500 |

4 |

10,000(=2500*4) |

|

On 10th |

2200 |

1 |

2,200(=2200*1) |

|

On 11th to 20th |

3000 |

10 |

30,000(=3000*10) |

|

21st to 25th |

2600 |

5 |

13,000(=2600*5) |

|

26th to 28th |

1400 |

3 |

5,200(=1400*3) |

|

29th |

1300 |

1 |

1,300(=1300*1) |

|

Total |

29 |

71,700 |

|

Effective

from April 2010, in the banks, SB interest is paid on Rs 71,700 for one day, as

if this amount is in

the account for only one day.

4.6.1 Problem 1: Find SB interest @4% in

case of a account holder having below mentioned

balances:

The balance

for April 2015 on all the days of the month be 2000.

The balance

for May 2015 all the days of the month be 2400.

The balance

for June 2015 all the days of the month be 1600.

Solution :

Since

the interest is calculated monthly in every quarter of the year (totally four

quarters in a year), the banks use a term called 'product' for easy calculation

‘Daily Product’ is defined as the balance at

the end of each day.

'Product'

is balance at the end of

the day* Number of days that balance is held.

In the

above Problem

Product

= 2000*30+2400*31+1600*30= 1,82,400. Interest at the rate of 4% is calculated on this

product for one day and the amount is credited to the SB account on 1st

month of next quarter (i.e. July)

For

interest calculation we use the following formula

Interest = P*(1/365)*(R/100)

Where

P = Principal (Product)

N =Period(one

day: 1/365 of year)

R = Rate of Interest

Since rate of SB interest is 4%

Interest =

P*(1/365)*(R/100) = 182400*(1/365)*(4/100)= Rs 19.9

This

amount of Rs 19.9 is credited to the SB account on 1st day of the

next month (i.e. July 2006)

Schedule

for crediting of SB interest in Banks normally is :

|

Interest for the months of |

Interest credit date |

|

January, February, March |

On April 1st |

|

April, May, June |

On July 1st |

|

July, August, September |

On October 1st |

|

October, November, December |

On January 1st |

4.6.1 Problem 2 : The following are extracts

a SB account holder in Karnataka Bank. Check the correctness of SB

interest calculated by bank for the quarter (April, May and June 2015) if the

SB rate of interest is 5%

|

Date |

Particulars |

Debit(-) |

Credit(+) |

Balance |

|

1/4/2015 |

Opening |

- |

|

1500.00 |

|

9/4/2015 |

To cheque |

300 |

|

1200.00 |

|

10/4/2015 |

By Cash |

|

100.00 |

1300.00 |

|

10/4/2015 |

To Cheque |

200.00 |

|

1100.00 |

|

1/6/2015 |

By cheque |

|

300.00 |

1400.00 |

|

15/6/2015 |

By cash |

|

300.00 |

1700.00 |

|

1/7/2015 |

By SB

interest |

|

16.05 |

1716.05 |

Solution:

Let us

find now the product for the three months starting from April 2015.

|

No. |

Month |

product |

Explanation |

|

1 |

April 2015 |

1500*8= 12000 1200*1= 1200 1100*21=23100 |

Up to 8th balance was 1500. 8th balance was 1200 On April 10th there were two

transactions and the closing balance was

1100 and it was same then for full month of April |

|

2 |

May 2015 |

1100*31=34100 |

May did not have any transactions and hence the

balance on all 31 days in May was 1100 |

|

3 |

June 2015 |

1400*14=19600 1700*16=27200 |

Up to 14th , balance was 1400 and then

for next 16 days it was 1700 |

|

|

Total |

117200 |

|

It is given

that rate of interest is 5%

![]() Interest = P*(1/365)*(R/100) = 117200*(1/365)*(5/100)= 16.05

Interest = P*(1/365)*(R/100) = 117200*(1/365)*(5/100)= 16.05

This amount of SB interest was

correctly credited by the bank to the account on 1st July 2015, From

July onwards; the SB interest credited to the account is also included for

monthly SB interest calculation.

Note :

1. Interest earned on a deposit of Rs 5000 for 30 days is equal to interest earned

on a deposit of 1,50,000(=5000*30) for one day

(![]() 5000*30 days = 150000*1day)

5000*30 days = 150000*1day)

2. Similarly interest earned on a deposit of Rs5, 000 for 12 months is equal

to interest earned on a deposit of Rs.60, 000(=5000*12) for one month.

(![]() 5000*12 months = 60000*1 month)

5000*12 months = 60000*1 month)

4.6.2 Interest on Savings Bank

account in Post offices:

In post offices also the method of

calculating SB interest is same as in Banks but the interest is credited only once a year on 1st of April. The monthly

minimum balance in Post office is called ‘Interest

bearing balance’ which is the lowest of daily balances between 10th

and the last day of any month.

The SB interest can be calculated

using the formula or Ready Reckoner

4.6.2 Problem 1 : Madhuri

has a post office SB account. The following are extracts of her pass book. Find

out the interest which gets credited to her account on 01/04/2000 if rate of SB

interest is 4%.

|

Date |

Debit(-) |

Credit(+) |

Balance |

|

1/4/99 |

- |

20.00 |

20.00 |

|

6/5/99 |

|

275.00 |

295.00 |

|

18/6/99 |

22.00 |

|

273.00 |

|

26/6/99 |

|

108.00 |

381.00 |

|

7/7/99 |

|

113.00 |

494.00 |

|

7/8/99 |

24.00 |

|

470.00 |

|

12/10/99 |

17.00 |

|

453.00 |

|

5/11/99 |

|

130.00 |

583.00 |

|

11/12/99 |

|

105.00 |

688.00 |

|

8/1/2000 |

95.00 |

|

593.00 |

|

22/2/2000 |

210.00 |

|

383.00 |

|

10/3/2000 |

|

38.00 |

421.00 |

Solution:

Let us

find now the ‘Interest

bearing balance’ (IBB) for all the 12 months starting from April 99 to March

2000

|

No. |

Month |

Lowest balance |

Explanation |

|

April’99 |

20 |

|

|

|

2 |

May’99 |

295 |

|

|

3 |

June’99 |

273 |

Rs 108

was deposited after 10th |

|

4 |

July’99 |

494 |

|

|

5 |

August’99 |

470 |

|

|

6 |

September’99 |

470 |

There

was no deposit or withdrawal in September |

|

7 |

October’99 |

453 |

On

10/10 the balance was 470 |

|

8 |

November’99 |

583 |

|

|

9 |

December’99 |

583 |

Rs 105

was deposited after 10/12 |

|

10 |

January’2000 |

593 |

|

|

11 |

February’2000 |

383 |

|

|

12 |

March’2000 |

421 |

|

|

|

Total IBB |

5038 |

|

We have seen that

Interest =

P*(N/12)*(R/100) = 5038*(1/12)*(4/100)= Rs 16.79

This

amount will be credited by post office on 1/04/2000 to the SB account of Madhuri

4.6.3. Interest

on other types of accounts in Banks:

What do people do when they

receive large amount of money (on retiring from service, on sale of property, .). In some cases they may need that money at a later

stage for buying of property. In such cases people normally invest such an

amount in Banks for a longer period.

1.

As Cumulative term deposit so that they get the invested amount along

with interest at the end of maturity (CTD)

2.

As Fixed deposits for a fixed time so that they can earn interest

regularly (FD)

4.6.3.1. Cumulative term deposit

(CTD)

In this scheme a fixed amount is

invested for a fixed period. The interest is paid at the end of the maturity

period along with initial deposit. This scheme is suitable for those who need

money after some time (buying property). The period is normally for few years.

The depositor needs to make an application to bank. On payment of initial

deposit bank issues a certificate to the deposit holder.

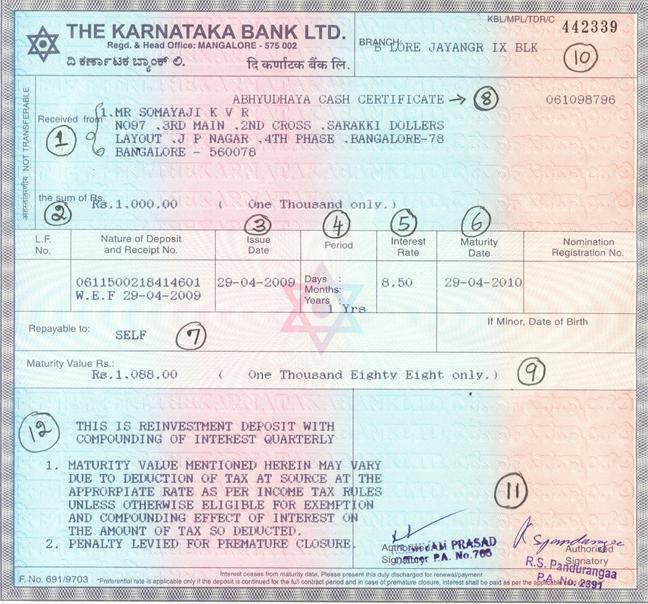

Let us look at an example of a CTD

issued by Karnataka Bank

Let us understand some important

details the above CTD has

|

Circled Number |

Details |

Entry in the above CTD |

|

1 |

Name

and address of the person |

Somayaji,

No 97, . . . |

|

2 |

Amount

of deposit in Figures and words |

Rs

1,000 One thousand |

|

3 |

Date

of deposit |

29-04-2009 |

|

4 |

Period

of deposit |

one

year |

|

5 |

Interest

Rate |

8.5% |

|

6 |

Maturity

(Due) Date (The

date on which Amount is payable) |

29-04-2010 |

|

7 |

Payable to whom |

Self |

|

8 |

Type

of deposit |

Abhyudaya (CTD) |

|

9 |

Maturity

value |

1,088 |

|

10 |

Name

of branch |

Jayanagara |

|

11 |

Signature

of Manager |

|

|

12 |

Other

terms |

|

In the above example the depositor

gets 1,088 after 1year on an investment 1,000( Thus he

gets in all 88 as Interest @8.5%%)

In effect in this scheme the

depositor gets interest on interest (called compound

interest).

Bank uses either a formula

(studied later) or a Ready Reckoner to find the compound interest

The Ready Reckoner for calculating

interest for few quarters @ 9% for different amount is as given below

|

Principal |

I

Quarter |

II

Quarter |

III

Quarter |

IV

Quarter |

|

100 |

102.2500 |

104.5506 |

106.9030 |

109.3083 |

|

200 |

204.5000 |

209.1013 |

213.8060 |

218.6167 |

|

300 |

306.7500 |

313.6519 |

320.7090 |

327.9250 |

|

…. |

….. |

…… |

….. |

…… |

4.6.3.2. Fixed Deposit (FD)

In this scheme a fixed amount is

invested for a fixed period and the interest is paid regularly (quarterly).

This scheme is suitable for those who need money regular interest for meeting

their monthly expenses. (Retired people). The period

can vary from few days to few years (say 7 days to 3 years)

The depositor needs to make an

application to bank. On payment of initial deposit bank issues a certificate to

the deposit holder which is similar to format of CTD.

The interest is calculated using

the formula:

Simple

Interest = P*N*(R/100)

Where

P = Initial deposit (Principal)

N = Period (Term) of Deposit in

years

R = Rate of Interest

4.6.3.3. Recurring Deposit (RD)

In this scheme, a depositor opens

an account with the bank agreeing to pay a fixed amount every month for few

months (three to six years)

After the maturity period, the

bank pays back sum of his all monthly installment amounts and also the

compounded interest. This scheme is useful for those who are in a position to

save a fixed amount every month(salaried employees,

fixed wage earner, shop owners…). RD accounts is helpful for those who need

fairly large amount after few years for buying items( vehicles, farm

equipments, ) and who have regular

monthly income and can save a fixed

amount every month. Normally

Banks use a Ready Reckoner to find

the amount payable at the end of maturity period.

The Ready Reckoner for repayment amount

for few months (6,12,24,36) for

different Interest rates(6,8,10) for a

monthly installment amount Rs 100 is given below.

|

Interest

Rate |

6 months |

….. |

12

months |

…. |

24

Months |

36 months |

…… |

|

6% |

610.5350 |

|

1239.5234 |

|

25555.1084 |

3951.4233 |

|

|

…… |

|

|

|

|

|

|

|

|

8% |

614.0622 |

|

1252.9326 |

|

2609.1471 |

4077.1572 |

|

|

…. |

|

|

|

|

|

|

|

|

…. |

|

|

|

|

|

|

|

|

10% |

617.5972 |

|

1266.4603 |

|

2664.3955 |

4207.4544 |

|

|

…. |

….. |

|

…… |

|

….. |

…… |

|

Note : Banks prepare above

Ready Reckoner after applying mathematical formula similar to

Maturity amount= P*(1+(R/100))

N + P*(1+(R/100)) N-1+ P*(1+(R/100)) N-2 + . .

. P*(1+(R/100)) 1

Where P is installment

amount per month. N = Number of months for which RD is opened, R= Rate of

interest per month.

4.6.3

Problem 1 : If Nanda

saves every month 50 Rupees for three years, find out how much she gets

at the end of three years @ 8% interest and

also the interest part in that amount.

Solution :

We find that for a monthly installment

of Rs 50 @ 8% for 36months, the amount mentioned in the above ready Reckoner is

4077.15(rounded)

Hence at the end of 36 months she will

receive Rs. 4077.15.

Since her monthly installment is

Rs 50 and not 100

She will receive 4077.15*50/100 =

2038.58(rounded)

What was the sum of all her monthly

installments?

Sum of monthly installment = Monthly

installment*Number of months = 50*36 = 1800

![]() Total interest

received = Amount received on maturity – Sum of monthly installments = 2038.58-1800

= 238.58.

Total interest

received = Amount received on maturity – Sum of monthly installments = 2038.58-1800

= 238.58.

Note:

1. In the above case

rate of interest per month is 8/12 (![]() Rate for 12 month is 8%)

Rate for 12 month is 8%)

2. The interest %

increases with the increase in period of deposit. The interest % offered by

various banks is almost same.

You can visit the

internet sites of the banks to know the applicable interest % for various periods

at any time.

|

No. |

Features |

Recurring Deposit(RD) |

Fixed Deposit(FD) |

Cumulative Term Deposit(CTD) |

|

1 |

Opened

by |

Individuals/ Business man or Companies |

||

|

2 |

Period

of deposit |

Fixed

number of months |

Fixed

number of days |

|

|

3 |

Amount

of deposit |

Fixed

amount every month |

Fixed amount in the beginning itself |

|

|

4 |

Refund

of deposit |

At the end of maturity period |

||

|

5 |

Payment

of interest |

At

the end of maturity period along with deposited amount |

Every

month/3 months/6 months/year |

At

the end of maturity period along with initial deposit |

|

6 |

Useful

for/when |

For

people with fixed income |

When in receipt/need of lump sum

amount |

|

|

7 |

Minimum

deposit |

Minimum amount varies from bank to bank |

||

|

8 |

Payment

of amount |

Credited to account or paid by cheque |

||

4.6.3.4. Bank

loans

When banks collect deposits from

public they need to find a way for disbursement (payments) of large amount of money with them.

This they do so by giving loans to individuals, companies, businessmen. Like

the way banks give

interest to depositors on deposits, they collect interest from borrowers of

loans.

The loans can be categorized as

1.

Demand loans

These are loans repayable on

demand. The borrower executes an agreement with the bank, promising the Bank to

repay the loan at the end of loan period.

Normally loan period is of short

duration less than 3 years. This type of loan is availed by individuals and ????

2.

Term loans

These are similar to demand loans

with the difference that term of loan is more than 36 months. This type of loan

is availed by individuals and

???

In the case of above two types of

loans, interest is calculated on the loan outstanding on a monthly balance

basis. Interest is collected (debited) quarterly. Banks calculate daily

products and on the sum of these daily products, they find the interest.

4.6.3.5.

Overdrafts

This is strictly is not a loan but

a financial arrangement of borrowing of amount for few days at a time. In this

type of arrangement the current account holder is allowed by the bank to draw

more than the balance amount in his account. The borrower and the bank agree on

a upper limit. The borrower can not draw more than

this limit. Overdraft facility is used mostly by traders and small businessmen

when they need extra money for a short period.

In the case of overdrafts,

interest is calculated on the loan amount outstanding at the close of day on a

day to day basis. Interest is collected (debited) quarterly

Calculation of interest on loans

Daily product = balance * number

of days the

same balance was outstanding

Interest = (Sum of daily products*

interest rate)/(100*365)

4.6.3 Problem 2: A person has taken a loan 1,00,000 on 15/1/01 at 12% He

repays 25,000 on 18/2/01 and Rs 10,000 on 16/03/01 and 40,000 on 28/4/01. The

loan was closed on 16/5/01. Calculate the interest compounded quarterly.

Solution :

We first need to find the balance

amount for each of the days from 15/1/01(Loan taken date) to 28/4/01(Loan

repayment date) as follows

|

Loan

amount balance |

Remarks |

From

date |

To Date |

Number

of days |

Daily

product = Balance*Number

of days |

|

100000 |

Initial

loan |

15/01/01 |

17/02/01 |

34(=17+17) |

3400000=100000*34 |

|

75000 |

Balance

reduced on 18/02/01 because of repayment of 25000 |

18/02/01 |

15/03/01 |

26(=11+15) |

1950000= 75000*26 |

|

65000 |

Balance

reduced on 16/03/01 because of next repayment of 10000 |

16/03/01 |

31/03/01 |

16 |

1040000=65000*16 |

|

Since the interest is compounded

quarterly, we need to calculate the interest up to the calendar quarter

ending 31/03/01. |

|||||

|

|

Sum

of daily products =6390000(=3400000+1950000+1040000) Interest

= (Sum of daily products* Interest rate)/(100*365) = (6390000*12)/(100*365)= 2100.82 ( rounded to 2100) Thus the amount outstanding as on 01/04/01 is 67100 ( = 65000 loan + interest of Rs 2100) |

||||

|

67100 |

Balance

increased by interest of Rs 2100. |

01/04/01 |

27/04/01 |

27 |

1811700

=67100*27 |

|

25000 |

Balance

reduced on 28/04/01 because of repayment of 40000 |

28/04/01 |

15/05/01 |

18(=3+15) |

450000=25000*18 |

|

0 |

Loan

closed on 16/05/01 |

|

|

|

|

|

|

Sum

of daily products =2261700(=1811700+450000) Interest

= Sum of daily products* Interest rate/100*365 = (2261700*12)/(100*365) = 743.57 |

||||

Thus the total interest paid = 2100.82+743.57 = 2844.39

4.6 Summary of learning

|

No |

Points learnt |

|

1 |

Method

of calculation of interest on SB

account in Banks and Post offices |

|

2 |

Method

of calculation of interest on loans |